Some Known Details About Pacific Prime

Some Known Details About Pacific Prime

Blog Article

The Ultimate Guide To Pacific Prime

Table of ContentsOur Pacific Prime IdeasNot known Factual Statements About Pacific Prime The Basic Principles Of Pacific Prime The Best Guide To Pacific PrimePacific Prime Fundamentals Explained

Insurance coverage is an agreement, represented by a plan, in which an insurance policy holder obtains monetary protection or compensation against losses from an insurance provider. The business pools customers' risks to make settlements extra economical for the insured. Most individuals have some insurance: for their cars and truck, their house, their health care, or their life.Insurance additionally aids cover costs associated with obligation (legal duty) for damages or injury triggered to a third celebration. Insurance is a contract (policy) in which an insurance company compensates an additional versus losses from details backups or risks.

Investopedia/ Daniel Fishel Lots of insurance plan kinds are readily available, and practically any type of private or organization can discover an insurance provider willing to insure themfor a price. Common personal insurance plan types are car, health, homeowners, and life insurance. The majority of individuals in the USA have at the very least one of these sorts of insurance policy, and cars and truck insurance policy is called for by state law.

The 4-Minute Rule for Pacific Prime

So discovering the cost that is best for you calls for some research. The policy limitation is the optimum amount an insurance firm will spend for a protected loss under a plan. Maximums may be set per duration (e.g., annual or plan term), per loss or injury, or over the life of the plan, likewise understood as the life time optimum.

Plans with high deductibles are usually more economical since the high out-of-pocket expenditure generally leads to fewer tiny cases. There are various sorts of insurance policy. Allow's check out one of the most important. Medical insurance assists covers routine and emergency situation medical treatment prices, typically with the alternative to add vision and oral solutions independently.

Several preventive services might be covered for totally free before these are fulfilled. Wellness insurance policy may be acquired from an insurance coverage company, an insurance policy agent, the government Health Insurance Market, provided by an employer, or federal Medicare and Medicaid protection.

Some Known Details About Pacific Prime

Rather than paying out of pocket for auto crashes and damages, individuals pay yearly premiums to an automobile insurance coverage business. The company after that pays all or the majority of the protected costs related to a car accident or various other car damages. If you have a rented automobile or borrowed cash to get an auto, your lending institution or renting dealership will likely need you to bring automobile insurance policy.

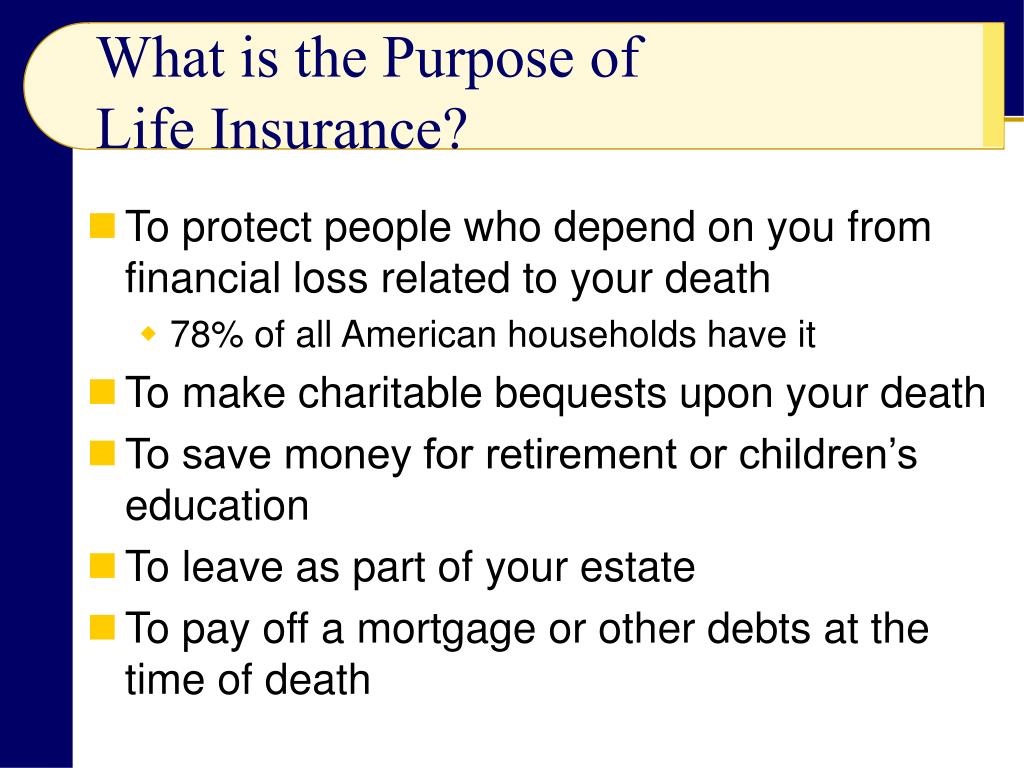

A life insurance plan assurances that the insurance provider pays an amount of cash to your beneficiaries (such as a spouse or children) if you die. In exchange, you pay costs throughout your life time. There are two primary types of life my blog insurance. Term life insurance policy covers you for a specific period, such as 10 to twenty years.

Insurance policy is a means to manage your monetary risks. When you purchase insurance coverage, you buy defense against unforeseen monetary losses.

Indicators on Pacific Prime You Need To Know

There are several insurance coverage policy kinds, some of the most typical are life, health, home owners, and automobile. The ideal sort of insurance for you will certainly rely on your goals and financial scenario.

Have you ever had a moment while looking at your insurance coverage policy or buying for insurance policy when you've thought, "What is insurance coverage? Insurance policy can be a mysterious and puzzling point. Exactly how does insurance policy job?

Nobody wants something poor to take place to them. Suffering a loss without insurance can put you in a challenging economic scenario. Insurance policy is an important financial tool. It can help you live life with fewer worries knowing you'll obtain financial support after a catastrophe or mishap, assisting you recuperate quicker.

The Ultimate Guide To Pacific Prime

And in many cases, like automobile insurance policy and employees' settlement, you might be called for by law to have insurance in order to secure others - group insurance plans. Discover ourInsurance alternatives Insurance coverage is basically a gigantic stormy day fund shared by many individuals (called policyholders) and taken care of by an insurance policy copyright. The insurer makes use of money accumulated (called premium) from its insurance holders and other investments to spend for its procedures and to fulfill its promise to insurance holders when they submit a claim

Report this page